lhdn stamp duty rate

Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. RM10000 or 20 of the deficient duty whichever is the greater if stamped after 6 months from the time for stamping.

Epf Lhdn Revise Operating Hours For Mco 3 0

The Stamp Duty rates on a transfer of residential property are.

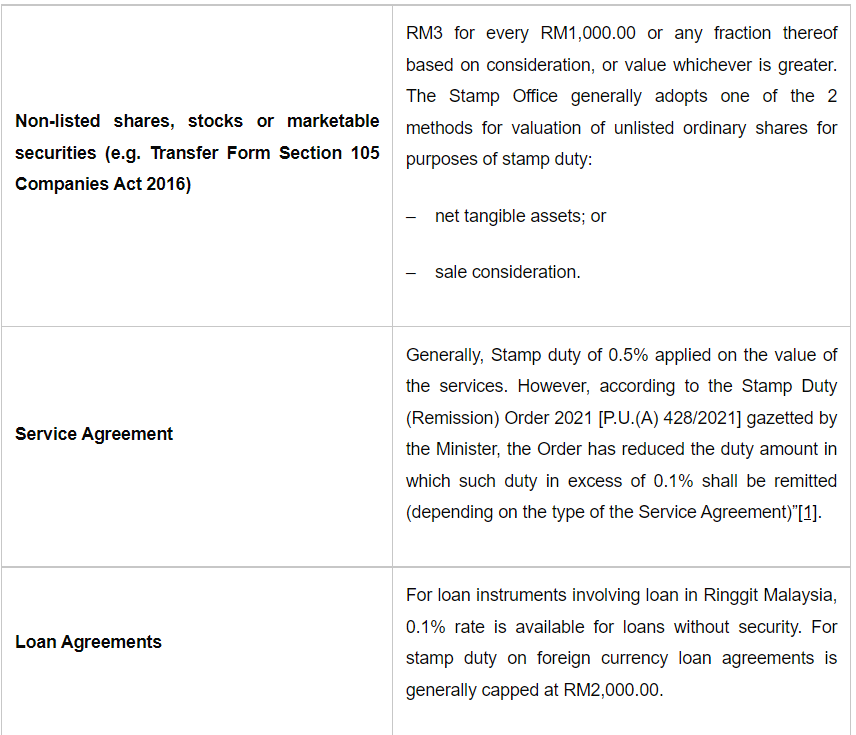

. Founded in 2010 we help over 10000 people each week locate accurate information. Ad Valorem Duty is the rate of duty varies according to the nature of the instruments and consideration stipulated in the instrument or the market value of a property. Where the property price or the adjudicated value is in excess of RM7500000.

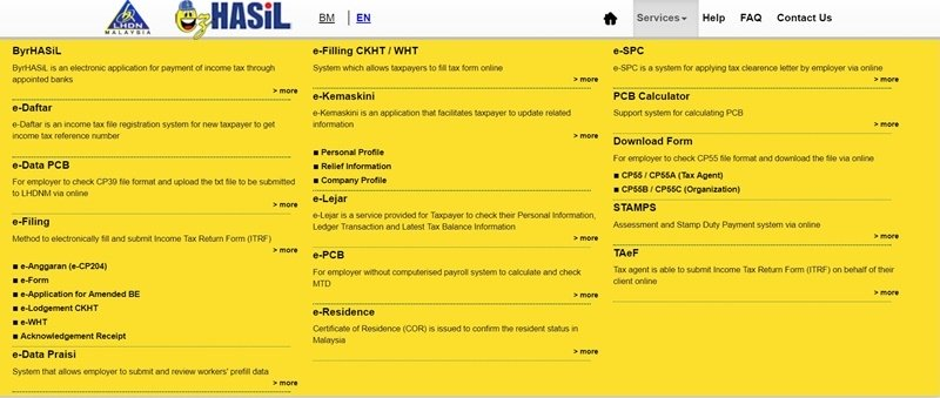

Based on the table below this means that for. Dimaklumkan aktiviti penyelenggaraan STAMPS akan dijalankan pada. For Example If the loan amount is.

1 on the first 1 million 2 on excess over 1 million. Is there a deadline for the stamping. Following the above the Stamp Duty Remission Order 2021 PU.

Stamp duty of 05 on the value of the services loans. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan. Every loan agreement tenancy agreement and property transfer document including the Sale and Purchase Agreement SPA that require stamping will be charged a fee or a.

The stamp duty for a tenancy agreement in Malaysia is calculated as the following. For the first RM100000 1 From RM100001 to RM500000 2 From RM500001 to RM1mio 3 The subsequent amount is 4. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

18102021 1000 Malam - 19102021 100 Pagi. Stamp Duty Rates is an impartial service for residential property buyers looking to find their tax liability. Hasil Stamp duty Exemption 2022 MOT Malaysia.

The stamp duty of the loan agreement is 05 of the total loan. There are no scale fees its a flat rate of 050 from the Total Loan Amount. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Sistem akan tidak dapat diakses pada waktu tersebut. However stamp duty may be subject to ad volarem rate of 01 depending on the type of the Service Agreement 1. The Property Stamp Duty scale is as follow.

Stamp Duty Payment Stamp duty payment can be. RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef. For the next RM2500000.

Application stamping fees for individual documents can be made via stamps from April 27. So for a property priced at RM500000 you would typically apply for a 90 loan. Stamp Assessment and Payment System STAMP merupakan sistem taksiran dan bayaran setem.

What is the stamp duty rate for Loan Agreement. These rates apply to instruments written documents executed. Its quite simple to calculate Loan Agreement Stamp Duty.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. If the documents are executed within Malaysia the documents must be stamped. In an effort to reduce the cost of ownership of first home for Malaysian citizens the government has proposed the following.

Negotiable on the excess but shall not exceed 05 of such excess. The stamp duty calculators give an indication of stamp duty liability for freehold residential property purchases in England Northern Ireland up to 23rd September 2022. The stamp duty on Loan Agreement is 05 on the total loan sum excluding financed insurance premium eg.

A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December.

Young Couples Should You Buy Or Rent In 2016

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Stamp Duty Malaysia 2019 New Updates Youtube

Tenancy Agreement Malaysia Properly

Tenancy Agreement Lhdn Stamping For Property Rental Pkp Mco 3 0 Property Others On Carousell

Revenue Stamps Of Malaysia Wikipedia

Property Tax 2019 Huge Tax Planning Opportunities For Real Properties With Latest Legal Framewor By Synergy Tas Issuu

Rpgt And Retention Sum Policy And Refund

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysian Tax Law Stamp Duty Lexology

How Important Of Stamping The Tenancy Agreement Dr Homesearch

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

Get Tax Compliance Advisory In Malaysia Wecorporate

Stamp Duty Malaysia Lhdn Archives Malaysia Housing Loan

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook

0 Response to "lhdn stamp duty rate"

Post a Comment